- Posted September 21, 2023

Tax Deadlines for 2023/24 – Key Dates for Self-Assessment Tax Returns

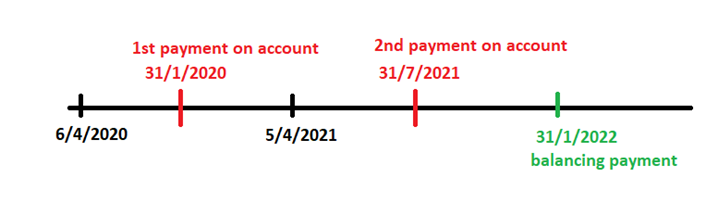

6th April – Start of the Tax Year The tax year runs from 6th April to 5th April the following year, any income earned in this period needs to be reported on your self-assessment tax return. This is also the date any new tax rates or allowances announced in the budget are implemented. Fun Fact: […]