Blog

Posted July 30, 2021

What is Payment On Account and How Do I Pay It?

Payment on account is the means by which individuals completing a self-assessment tax return pay their tax.

The Payment On Account system does not apply to all individuals, you will only need to make payments if less than 80% of your income has been taxed at source and your liability is more than £1,000.

Tax deducted at source is where your income is taxed before you receive it, eg where you are paid under the Pay As You Earn (PAYE) system or under the Construction Industry Scheme (CIS).

What is Payment On Account?

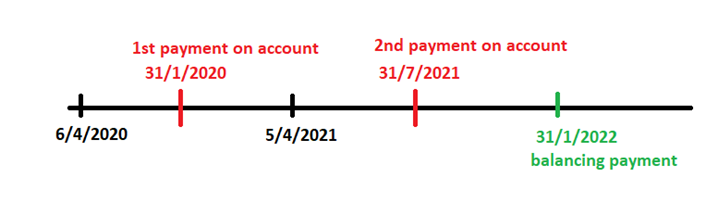

The payment on account system means HMRC expect you to pay your tax in two instalments based on your prior year’s tax liability. The first payment is due on 31 January that falls within the tax year and the second payment on 31 July following the end of the tax year. A further balancing payment is due by 31 January following the end of the tax year if you have under paid. Below is a handy diagram of how this works for the 2020/21 tax year.

Can I Reduce My Payments On Account?

If you think your payments on account are too high because your tax bill for the following year will be lower, you can apply to reduce your payments on account.

This can be done on your tax return, over the phone or you can write to HMRC.

You should only reduce your payments on account if your tax bill will be less, if you reduce them too much HMRC will charge you penalties and interest on the underpayment.

If you are experiencing cashflow problems, you should contact HMRC immediately to arrange a payment plan.

Does my Payment on Account Include Student Loans?

Your payment on account does not include any payment towards your student loan. Payment of capital gains tax is also not collected in the payment on account.

How Do I Pay My Payment on Account?

You can pay your payment on account, online, over the phone, via post or via cheque or cash at your bank. These are the details to make the payment Pay your Self Assessment tax bill – GOV.UK (www.gov.uk)

What is the Payment Reference Number for my Payment on Account?

Your payment reference is your 10 digit UTR (unique tax payers reference) with a K at the end.

How Do I Check What my Payment On Account Is?

You can check your payment on account amount in your personal tax account on your government gateway. To log-in to your government gateway follow this link: HMRC services: sign in or register – GOV.UK (www.gov.uk)

Once you have logged in, click “view statements” and you can see your account, details of the tax due and any payments you have made together with any reallocations HMRC has done.

SERVICES

LATEST NEWS

CATEGORIES

- Blog (137)

- Business Advice (45)

- Just For Fun (16)

- Tax Tips (30)

- Video (8)